America’s interest rates are unlikely to fall this year

That will squeeze financial markets and the world economy

For most of the year everyone from stockpickers and homebuyers to President Joe Biden has banked on the Federal Reserve cutting interest rates soon. Over the past two weeks those hopes have been dashed. Annual consumer price inflation in March, at 3.5%, was higher than expected for the third month in a row; retail sales grew by a boomy 0.7% on the previous month. On April 16th Jerome Powell, the Fed’s chairman, warned that the battle against inflation was taking “longer than expected”. Investors had begun 2024 pricing in more than 1.5 percentage points of interest-rate cuts over the course of the year. Today they expect rates to fall by only 0.5 points.

Explore more

This article appeared in the Leaders section of the print edition under the headline “The second Powell pivot”

Leaders April 20th 2024

More from Leaders

Germany’s failure to lead the EU is becoming a problem

A weak chancellor and coalition rows are to blame

How to ensure Africa is not left behind by the AI revolution

Weak digital infrastructure is holding the continent back

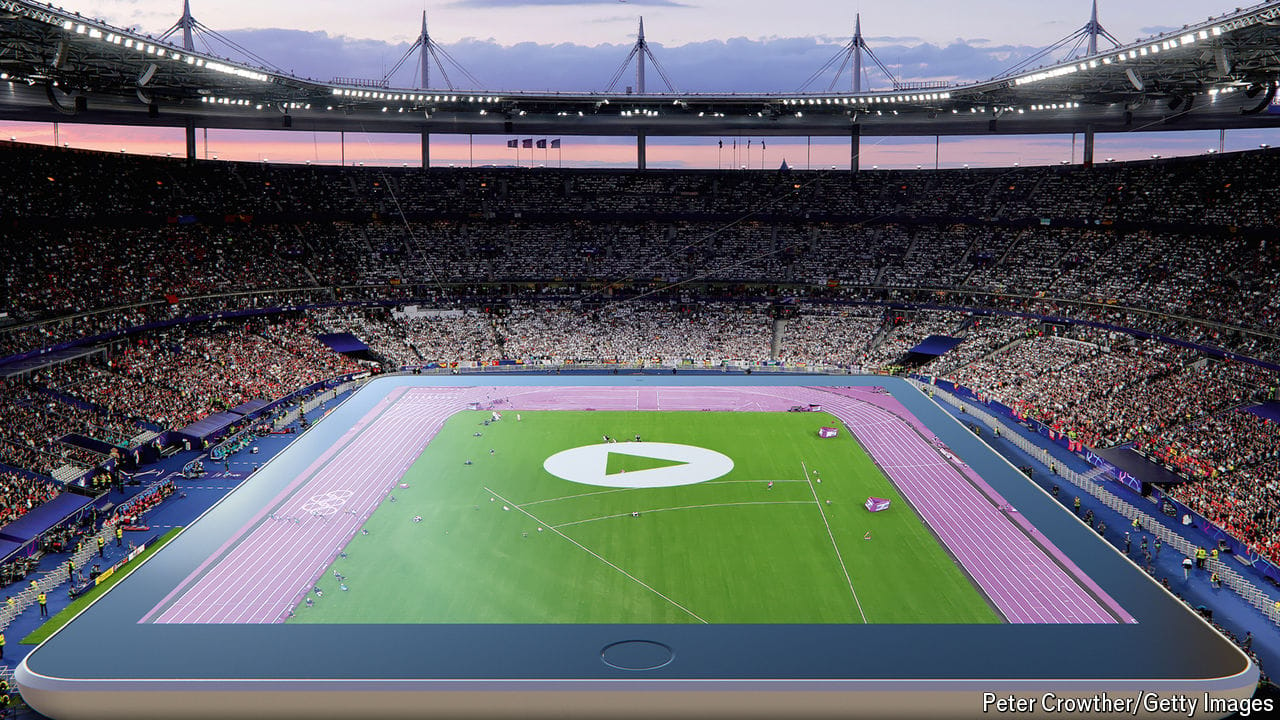

A global gold rush is changing sport

Fans may be cooling on the Olympics, but elsewhere technology is transforming how sport is watched

Can Kamala Harris win?

Joe Biden’s vice-president has an extraordinary opportunity. But she also has a mountain to climb

MAGA Republicans are wrong to seek a cheaper dollar

It is hard to cast America as a victim of the global financial system

Joe Biden has given Democrats a second chance to win the White House

If they are not to squander it, they must have a proper contest