European banks are making heady profits in Russia

But for how much longer?

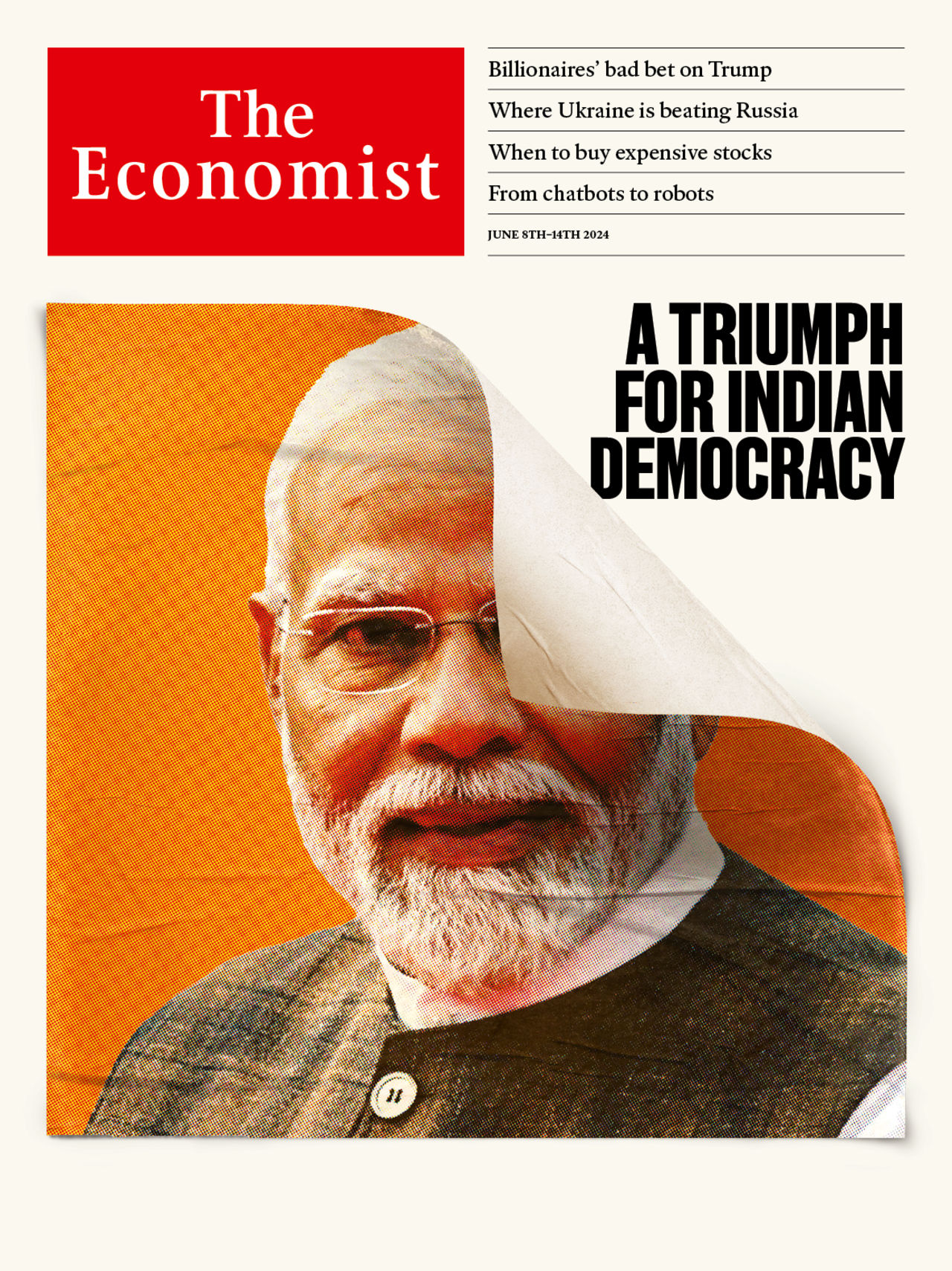

Days after Vladimir Putin’s invasion of Ukraine, Raiffeisen, an Austrian bank, said it was considering selling its business in Russia. Twenty-seven months later, the lender’s unit in the country is doing rather well. Its staff has grown to nearly 10,000, a 7% rise since 2022. Last year its profit reached €1.8bn ($2bn)—more than any of the bank’s other subsidiaries and a tripling since 2021. Raiffeisen is one of a dozen lenders that Russia deems “systemically” important to its economy. The bank also matters to the Kremlin’s own finances, since it paid the equivalent of half a billion dollars in tax last year.

Raiffeisen is the biggest Western bank in Russia, but not the only one. The combined profits of the five EU banks with the largest Russian operations have tripled, reaching nearly €3bn in 2023. Success makes the banks a target. In May America threatened to curb Raiffeisen’s access to its financial system because of the bank’s Russian dealings. On June 10th, in an attempt to placate critics, the lender plans to stop making dollar transfers out of the country. Russia, for its part, is starting to seize the assets of Western banks it deems “unfriendly”. Western lenders’ Russian paper profits are at risk of turning to ash.

Explore more

This article appeared in the Finance & economics section of the print edition under the headline “Rouble-rousers”

Finance & economics June 8th 2024

More from Finance and economics

China’s last boomtowns show rapid growth is still possible

All it takes is for the state to work with the market

What the war on tourism gets wrong

Visitors are a boon, if managed wisely

Why investors are unwise to bet on elections

Turning a profit from political news is a lot harder than it looks

Revisiting the work of Donald Harris, father of Kamala

The combative Marxist economist focused on questions related to growth

Donald Trump wants a weaker dollar. What are his options?

All come with their own drawbacks

Why is Xi Jinping building secret commodity stockpiles?

Vast new holdings of grain, natural gas and oil suggest trouble ahead