Why investors are unwise to bet on elections

Turning a profit from political news is a lot harder than it looks

To meet the world’s biggest news junkies, head not to Washington or Westminster. Instead, make your way to a trading floor, where information from every corner of the globe must be parsed the instant it emerges. Whatever the news, from coups to company-earnings reports, it probably affects the price of something. This year, amid a seemingly never-ending series of elections, the addicts are not short of a fix. Electorates representing most of the world’s population are heading to polling booths, and not just market-makers but investors everywhere face the tantalising prospect of trading on the results.

Explore more

This article appeared in the Finance & economics section of the print edition under the headline “Democratic deficit”

Finance & economics July 27th 2024

- The rich world revolts against sky-high immigration

- Donald Trump wants a weaker dollar. What are his options?

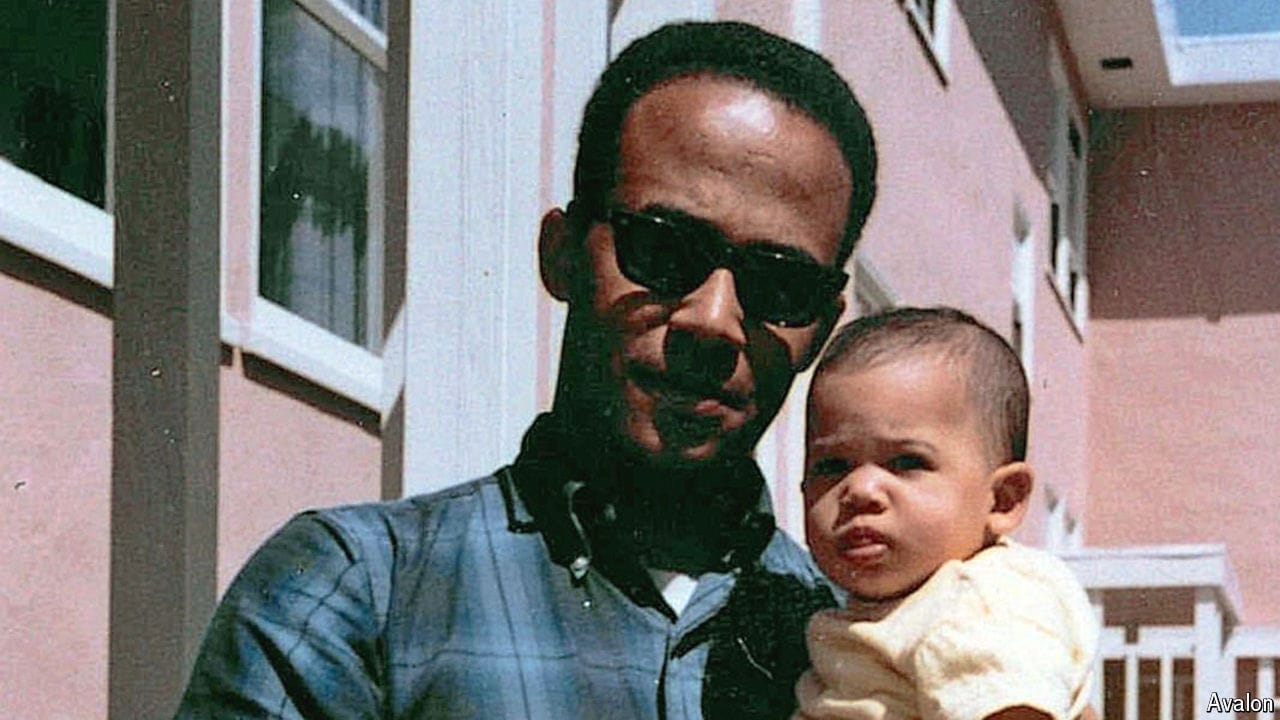

- Revisiting the work of Donald Harris, father of Kamala

- How Vladimir Putin created a housing bubble

- Why is Xi Jinping building secret commodity stockpiles?

- Why investors are unwise to bet on elections

More from Finance and economics

China’s last boomtowns show rapid growth is still possible

All it takes is for the state to work with the market

What the war on tourism gets wrong

Visitors are a boon, if managed wisely

Revisiting the work of Donald Harris, father of Kamala

The combative Marxist economist focused on questions related to growth

Donald Trump wants a weaker dollar. What are his options?

All come with their own drawbacks

Why is Xi Jinping building secret commodity stockpiles?

Vast new holdings of grain, natural gas and oil suggest trouble ahead

How Vladimir Putin created a housing bubble

Prices have risen by 172% in Russia’s biggest cities over the past three years