Boom times are back for container shipping

Can they last?

Volatile weather is a peril of the high seas. Volatile markets are similarly treacherous for the container-ship industry, which carries 80% of the volume of internationally traded goods. A global pandemic, which kept people at home with little else to do but buy, buy, buy, sent container rates sky-high. In 2022 shipping lines’ return on capital exceeded 40%; the biggest earned profits that were three times the total for the previous two decades combined. Rates and returns tumbled as demand waned and shipping companies started to receive the new vessels ordered during the boom. Then attacks by Houthi rebels on ships in the Red Sea all but closed the Suez Canal. The disruption has sent rates back to records surpassed only during the pandemic. How long will the good times last this time?

On the surface, the answer should be: not long at all. Historically, value destruction has been the industry norm. Bernstein, a broker, reckons that between 2002 and 2019 shipping firms’ average return on capital of 4.7% trailed in the wake of its cost of capital, which averaged 10% or so. New ships take a couple of years to build. According to bimco, an industry association, in 2023 the global fleet added capacity of around 2.3m 20-foot equivalent units (the standard measure of container size), surpassing the previous annual record by 37%. Another 1m arrived in the first four months of 2024. In February worries about overcapacity led A.P Moller-Maersk, the world’s second-largest shipping line, to warn it could lose up to $5bn this year.

This article appeared in the Business section of the print edition under the headline “Full steam ahead”

Business June 29th 2024

- Is the revival of Paris in peril?

- European millionaires seek a safe harbour from populism

- A new lab and a new paper reignite an old AI debate

- Why everyone should think like a lawyer

- Why big oil is wading into lithium

- Boom times are back for container shipping

- Who shaved $250bn from Kweichow Moutai’s market value?

- Is artificial intelligence making big tech too big?

More from Business

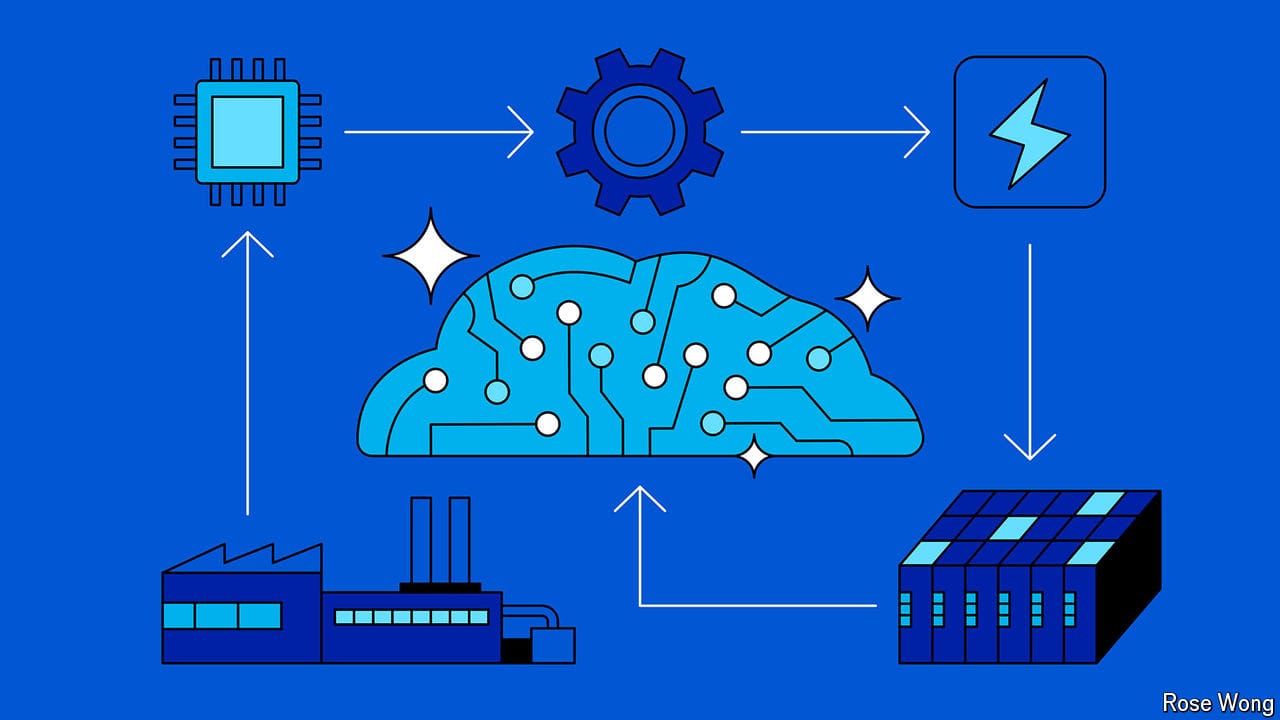

What are the threats to the $1trn artificial-intelligence boom?

A fast-growing supply chain is at risk of over-extending

LVMH is splurging on the Olympics

Will it pay off?

Can China smash the Airbus-Boeing duopoly?

It hopes to succeed where others have failed

Machines might not take your job. But they could make it worse

How robots and AI change the meaningfulness of work

Why is Mark Zuckerberg giving away Meta’s crown jewels?

Augustus Caesar goes on the open-source warpath

Donald Trump’s promise of a golden age for oil is fanciful

There is not much he could do to boost fossil fuels—or rein in clean energy