Time to fix the way governments tax multinational companies

The answer lies in reducing incentives to shift profits to havens

TAX COMPANIES too much, and growth will shrivel. Tax them too little, and resentment will soar. The public and politicians in Western countries have long thought the treatment of multinationals falls too close to that second extreme. Now the system is reaching breaking-point. Over 40 countries are squabbling over how to impose levies on Silicon Valley firms. Meanwhile the pandemic is forcing governments to find ways to plug their fiscal deficits, not least the Biden administration, which wants to increase multinationals’ tax rate.

This article appeared in the Leaders section of the print edition under the headline “End the contortions”

Leaders May 15th 2021

More from Leaders

Germany’s failure to lead the EU is becoming a problem

A weak chancellor and coalition rows are to blame

How to ensure Africa is not left behind by the AI revolution

Weak digital infrastructure is holding the continent back

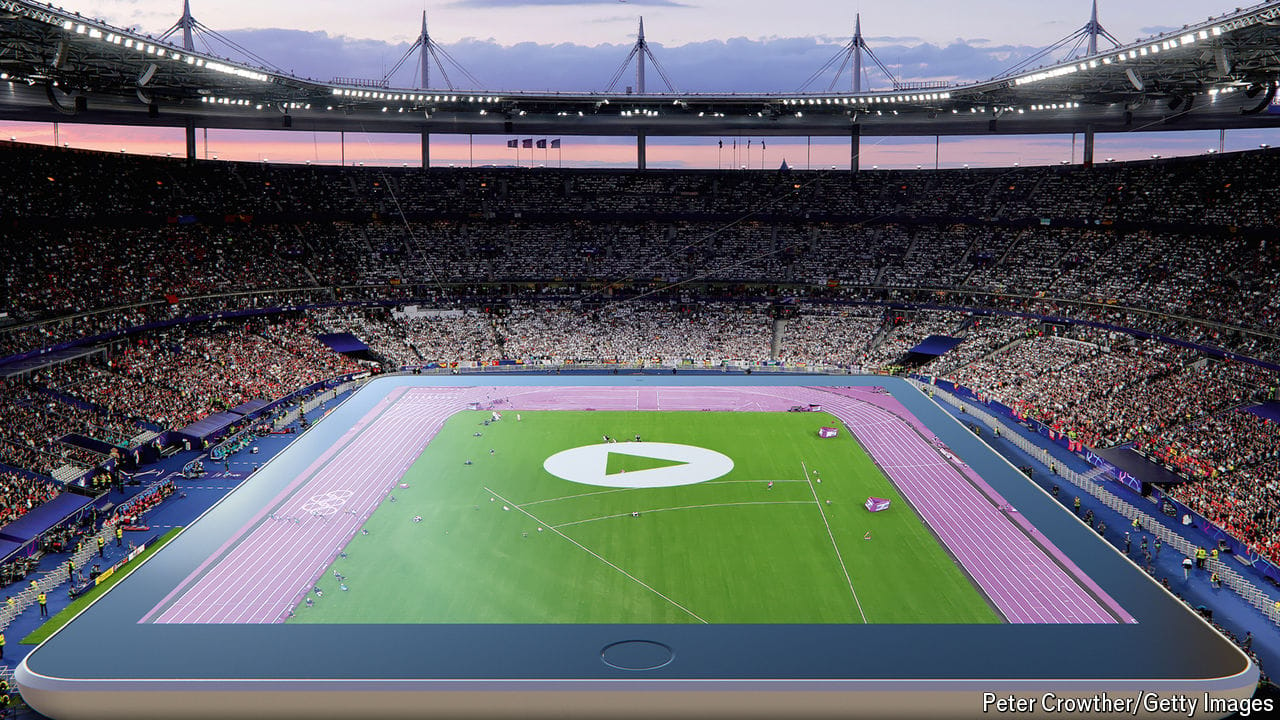

A global gold rush is changing sport

Fans may be cooling on the Olympics, but elsewhere technology is transforming how sport is watched

Can Kamala Harris win?

Joe Biden’s vice-president has an extraordinary opportunity. But she also has a mountain to climb

MAGA Republicans are wrong to seek a cheaper dollar

It is hard to cast America as a victim of the global financial system

Joe Biden has given Democrats a second chance to win the White House

If they are not to squander it, they must have a proper contest