Japanese businesses are trapped between America and China

Could geopolitics kill off an incipient corporate revival?

Not since the 1980s have Japanese businesses generated so much excitement. Japanese companies’ profit margins have doubled in the past decade or so. They are forking out twice as much to their owners in the form of dividends and share buy-backs as they did ten years ago. Shareholder-friendly changes to corporate governance in Japan have caused foreign investors to flock to the country once again. Having languished for decades, the Nikkei 225 index, which tracks the value of the country’s largest listed firms, is up by 25% over the past year (see chart 1). In February it at last exceeded the record it set in 1989, just before Japan’s bubble burst.

Explore more

This article appeared in the Business section of the print edition under the headline “Flyover country”

More from Business

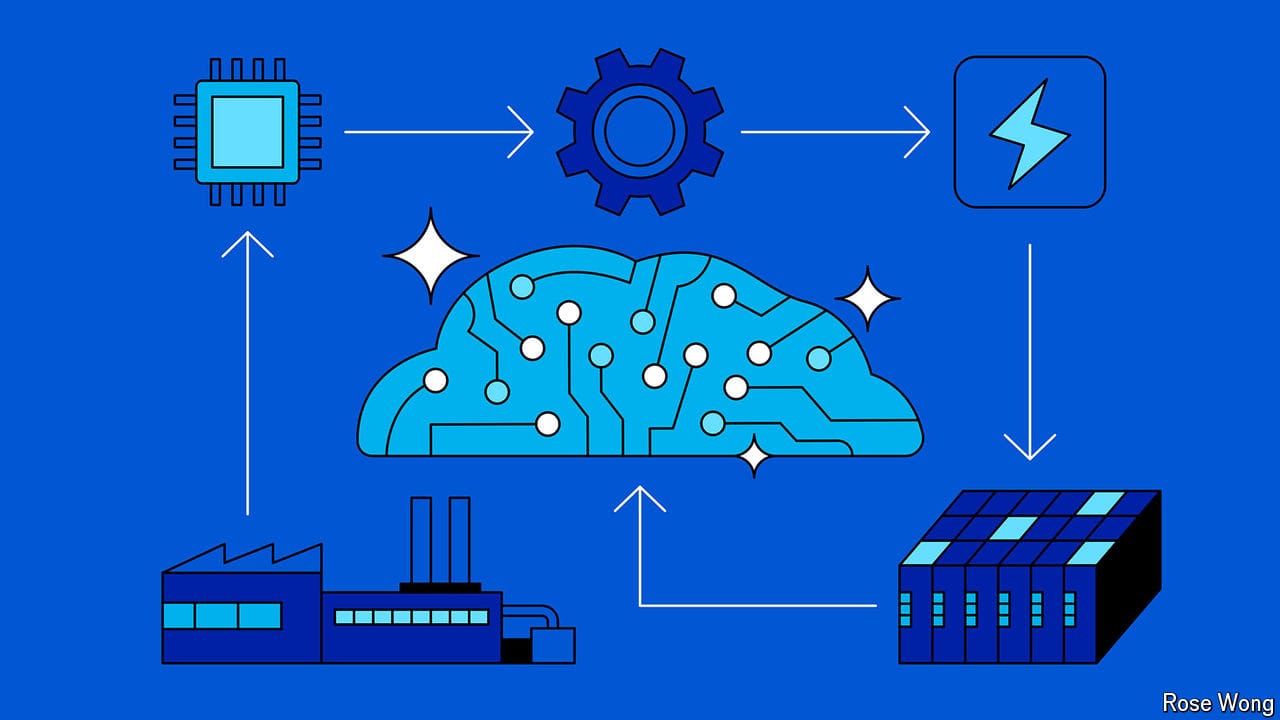

What are the threats to the $1trn artificial-intelligence boom?

A fast-growing supply chain is at risk of over-extending

LVMH is splurging on the Olympics

Will it pay off?

Can China smash the Airbus-Boeing duopoly?

It hopes to succeed where others have failed

Machines might not take your job. But they could make it worse

How robots and AI change the meaningfulness of work

Why is Mark Zuckerberg giving away Meta’s crown jewels?

Augustus Caesar goes on the open-source warpath

Donald Trump’s promise of a golden age for oil is fanciful

There is not much he could do to boost fossil fuels—or rein in clean energy