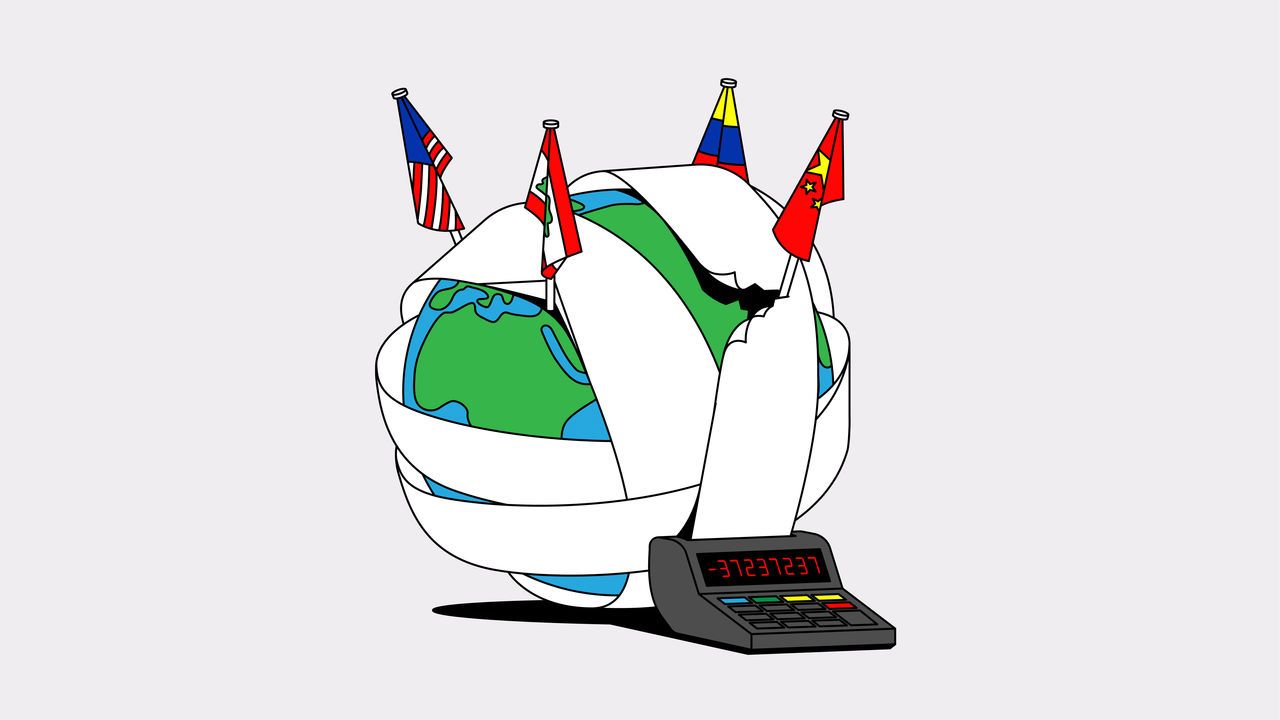

The world’s most indebted countries face another year in limbo

Geopolitical tensions have frozen the process of debt restructuring

By Cerian Richmond Jones

Twenty years ago, debt restructurings were a triumph of multilateralism. Governments and banks, watched over by the IMF, worked together to reduce the debts of countries that could no longer pay their bills. In return, poor countries agreed to the kind of free-market reforms that had made their creditors prosper. An official “Heavily Indebted Poor Countries” (HIPC) plan made write-downs of huge swathes of debt routine and relatively painless. Restructurings were proof of globalisation going well, and of the benevolence of rich countries at the helm.

Not any more. In 2024 the collapse of that system will continue. It has been at least three years since China agreed to a deal that writes down debts. The world’s fragmenting geopolitics now plays out in miniature in each creditor meeting. Beijing refuses to play by Western financiers’ rules, but as the world’s biggest creditor, it is too big to ignore. At least 21 countries were in default or seeking restructuring but only Zambia managed to get a deal done involving China.

This article appeared in the Finance section of the print edition of The World Ahead 2024 under the headline “Another year in limbo”