Can countries lower taxes and raise revenues?

The Laffer curve exists in principle, but the sweet spot is hard to find

RARELY has a dinner-table scribbling created such a legacy. In 1974 Arthur Laffer, an economist, sketched a simple diagram on the back of a napkin to illustrate a truism of tax policy. Set income-tax rates to zero and governments will not collect any revenue. Set them to 100%, and they will also collect nothing because people will have little incentive to work. Somewhere in between lies a sweet spot where government revenues are maximised. From this simple proof, it follows that when tax rates are very high, it might be possible both to lower tax rates and raise revenues. Tax cuts might thus pay for themselves, and more.

Mr Laffer’s scribbling caught on. Some 45 years later some 15,000 journal articles mention the “Laffer curve” in their title. Today President Donald Trump will award the Presidential Medal of Freedom, America's highest civilian honour, to Mr Laffer—an adviser to Mr. Trump’s 2016 presidential campaign and co-author of the book “Trumponomics”. In its announcement of the event, the White House described Mr Laffer as “one of the most influential economists in American history.”

More from Graphic detail

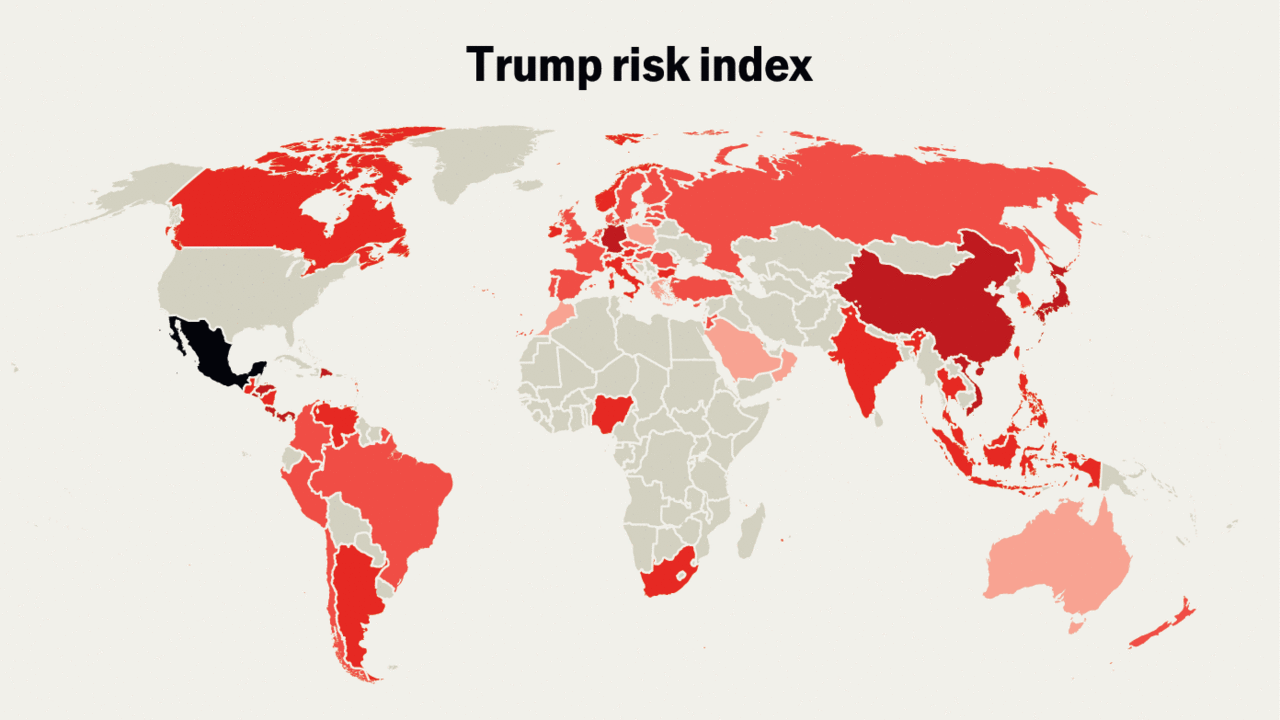

Which countries would be most affected by a second Trump term?

A ranking of America’s 70 largest trading partners

How long would it take to read the greatest books of all time?

The Economist consulted bibliophile data scientists to bring you the answer

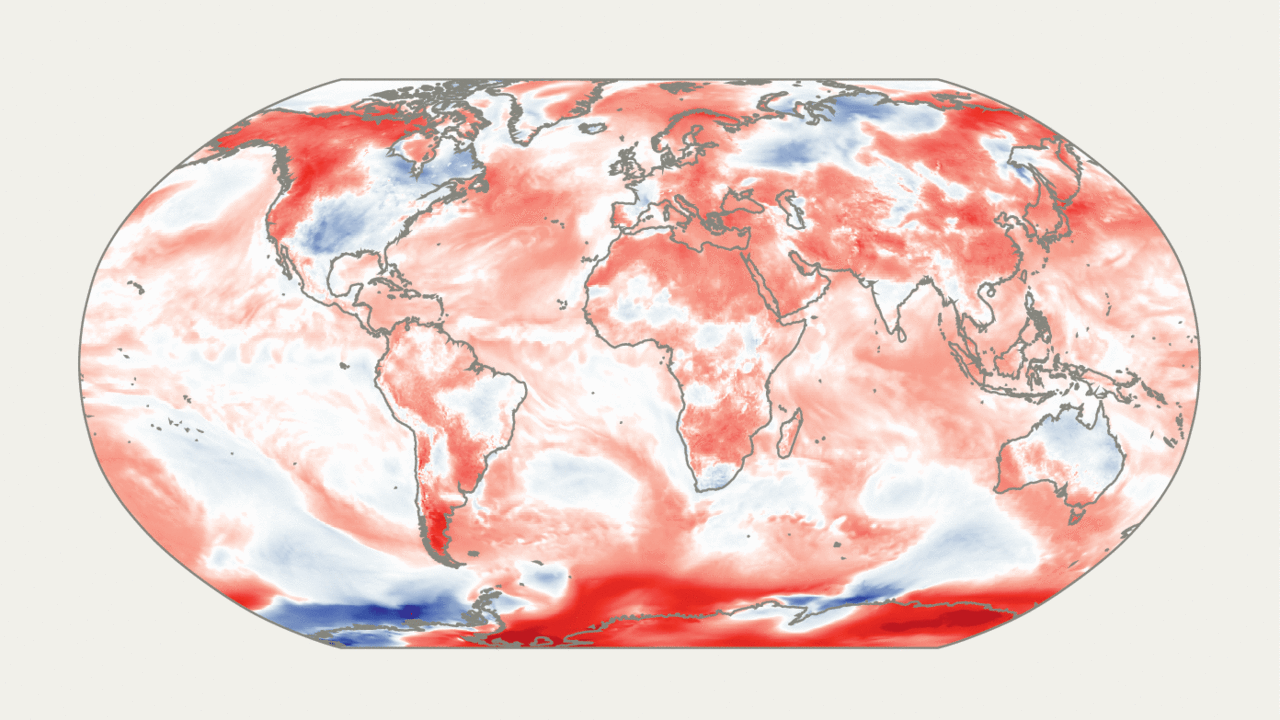

Why 2024 could become the hottest year on record

Global temperatures reach record highs twice in less than a week

Donald Trump is now the oldest candidate to run for president

But America’s issue with ageing politicians goes beyond the White House

Which country has the most Olympic medals?

One dominates. But a tiny island shows there are numerous ways to measure sporting prowess

Can America afford its debts?

Public debt stands at 98% of GDP. Neither Democrats nor Republicans are helping